Credit Card Consolidation

What is Credit Card Consolidation?

If you have outstanding balances on your credit cards, you may choose to consider consolidating them as a debt relief option. By consolidating your credit card debts, you may be able to escape the trap of making minimum payments, battling mounting interest rates, and watching your balance continually increase.

Fighting The Minimum Payment Trap

Credit card companies typically require a small minimum monthly payment. While it may seem convenient, it can trap you: The purpose of the minimum payment is to prolong the amount of time it takes to pay off the balance, keeping you in debt. In some cases, it can take up to 20 years to pay off balances.

Battling Increasing Balances

Credit card companies make money by charging interest on balances. Their interest is profit, not helping you get out of debt, so the longer it takes you to pay off your balances, the more money they make.

See the example below:

| Credit Card Balances | $25,000 |

| Interest Rate | 17% |

| Minimum Payment | 2% of the Balances Owed |

| Time to pay off Balances | 600 Months |

| Total Interest Paid | $58,617.95 |

Source: Creditcards.com (Minimum Payment Calculator)

In 2009, Congress passed a bill requiring credit card companies to provide consumers with detailed information about how long it will take them to pay off their debts by making minimum payments. When you open a new card, make sure you are informed about what minimum payments can cost you, and beware of paying more than you should.

How Does Our Program Work?

Through our reputable credit card consolidation program, you will work with our financial experts to construct a plan that works for you. The benefits are twofold:

Get Out of Debt

Juggling multiple credit card balances is stressful. We will help you manage your payments by rolling them into a single amount owed. That way, you can focus on paying down your debt without scrambling to find the money to pay off various creditors.

Pay Less in Interest

Making minimum monthly payments to multiple companies with varying interest rates can make it difficult to know just how much money you are losing over time. Consolidating your credit card balances can help you escape the minimum payment trap that results in paying inflated amounts in interest over time.

Is Consolidating Credit Card Debt a Good Idea for You?

You may want to consider consolidating your debt if:

- You’ve been stuck making minimum payments.

- Your balances are not decreasing.

- You’re transferring balances from one credit card to another.

What are The Best ways to Consolidate Credit Card Debt?

There are three primary ways to consolidate your credit card debt. Our financial experts will help you select the option that is best for you.

Credit Card Balance Transfers

Transferring balances between credit cards can be tricky. However, in some cases, it can help you get out of debt.

How It Works: Balance transfers involve moving your credit card balances to a separate card with a new credit limit and a lower interest rate. We will help you negotiate the best terms for your transfer, including a feasible payoff period.

Debt Consolidation Loans

If you have a good credit score and your debt to income ratio supports the amount of debt that you owe, you may consider a debt consolidation loan.

How It Works: This option involves applying for a new loan – with more favorable interest rates – to pay off your high-interest credit card debts. Then, you will work with your creditor to pay back the consolidation loan.

Debt Consolidation Programs

If your credit is poor, a debt consolidation company can help you negotiate the terms of your debts.

How It Works: Debt consolidation programs focus on reducing your credit card debt by negotiating with your credit card companies. This option is best for those who do not meet the credit and income requirements for a balance transfer or consolidation loan.

Do You Qualify for Credit Card Consolidation?

Based on the nature and amount of your debt, your credit history, and other factors, your eligibility for consolidation options will vary. Here is a basic summary:

| Credit | Income / Payment History | |

|---|---|---|

| Balance Transfer | Good to Excellent | No Delinquent Payments Income must support monthly payments |

| Consolidation Loan | Good to Excellent | No Delinquent Payments Income must support monthly payments |

| Consolidation Program | Credit not required | Program payments are custom tailored based on affordability index |

Why Consider CountryWide Debt Relief?

With 30+ years of combined experience in helping people find a solution to getting out of debt, CountryWide Debt Relief can help you find the Best Debt Consolidation Option. Here are a few reasons why you should consider CountryWide Debt Relief:

See What Our Customers Say

“I am retired and I will be turning 72 this year. Oh boy I have been so stressed with all these credit card payments. Not only do I make my payments on time, but I never seem to see the balances go down…CountryWide Debt Relief… programs would not only keep my monthly payments affordable but he gave me a light at the end of the tunnel. Finally I am so relieved that my payments will eventually get me out of this debt without doing bankruptcy..”

Consuelo W.

Oceanside, CA

Proven Results

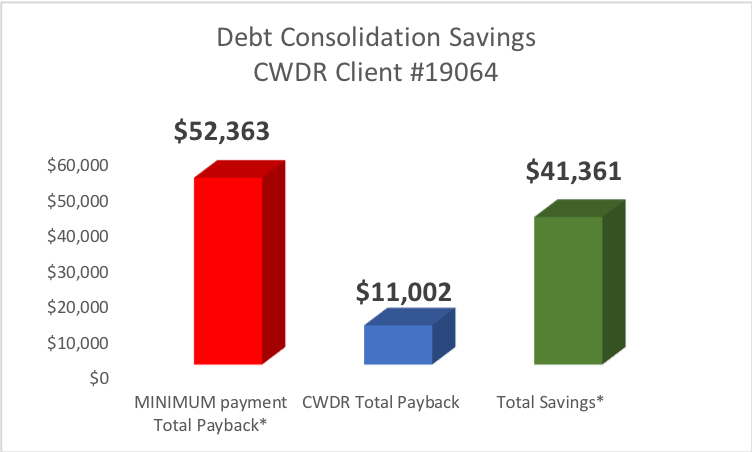

Case Study: Client #19064 from Oceanside, CA saved $41,361 thru Countrywide’s Debt Consolidation Program

THE PROBLEM:

Client #19064 from Oceanside, CA hired CWDR because they were having a difficult time making the minimum payments to their debts due to loss of financial provider.

THE SOLUTION:

The Credit Card Consolidation Program thru CWDR was able to help client # 19064 save $41,361*. Client had $15,844 in debt and making just the minimum payments each month it would have taken 523 months to payoff the debt and the client would have paid back $52,363. The Credit Card Consolidation Program helped this client get out of debt in 39 months.

Other Debt Relief options that people look for when doing Debt Consolidation are:

- Consolidation Loan

- Consolidation Programs

- Credit Card Consolidation

- Debt Relief Program

- Credit Counseling

- Debt Management

- Debt Negotiations

- Debt Restructure

- Debt Resolution

- Bankruptcy

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.

Frequently Asked Questions

How does credit card debt consolidation affect your credit report?

The impact of debt consolidation on your credit depends on a variety of factors. For instance, the age of your debt and your current payment status are two key factors that will affect whether your credit will improve long-term or if you will see a negative short-term impact.

Can credit cards be used while enrolled in a consolidation program?

Generally, yes: you can continue to use any credit card that is not enrolled in the program.

Will the monthly payment be fixed or can we increase the payments?

Once enrolled, the program payments remain the same. However, in some cases, you can increase your payments and finish the program sooner.

Can a credit card company sue you for unsecured debt?

Yes, a credit card company can sue you if you fall behind on making the required monthly payments.

Is it better to settle credit card debt or pay in full?

If you have the ability to pay your credit card debt without causing financial stress then you definitely should However, if paying off credit card debt is causing you stress or putting a strain on your finances, then a settlement option might be a good alternative.

Who can apply for credit card consolidation programs?

A credit card consolidation program is ideal for those who are unable to afford their required monthly payments or for those who do not see the balances on their debts decreasing.

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (800)-594-3362