Debt Relief, Simplified!

CountryWide Debt Relief (CWDR) is Debt Consolidation company offering financial solutions to consumers that are looking to get out of debt. We have helped thousands of people save millions of dollars. Our Debt Relief solutions can help you get out of debt within 24-60 months. We focus on offering you a solution that can get you out of debt quickly while maintaining an affordable monthly payment.

Getting Help is Easy!

Fast Approval

Get approved in

Minutes

Bad Credit O.K

Credit is not required

to get Approved

Low Monthly Payment

Consolidate your Debts into

One Low Manageable Payment

Why Choose CountryWide?

At CountryWide, we are dedicated to helping our customers navigate financial challenges and relieve the pressures of burdensome debt. We specialize in helping individuals and families choose the best options for debt relief that are tailored to help them effectively meet their financial goals and needs.

With expertise, compassion, and a track record of proven results, we stand ready to help you resolve your debt so that you can work toward your financial goals.

What We Offer:

Tailored debt relief services as per your needs, requirements and budget

Free Consultation from a Debt Consultant with no upfront cost

Hassle-free debt consolidation solutions that are quick to implement and easy to follow

How It Works

#1: Sharing Your Objective

Before you get started on your journey toward financial independence, we help you become clear about your objectives. This includes meeting with one of our Debt Consultants to share your financial goals and build a strategy through which you’d like to pay off your debt.

#2: Identifying Your Options

Our expert team will then help you choose from a wide range of options to increase your financial flexibility and independence. This may come in the form of consolidating your debts or getting a portion of your debts settled.

#3: Supporting You in Your Journey

As you work to pay off your debts through a consolidation or repayment plan, we will be there to answer all your questions and will act as a trusted partner. With our help, you could be debt-free in 12-60 months.

Proven Results

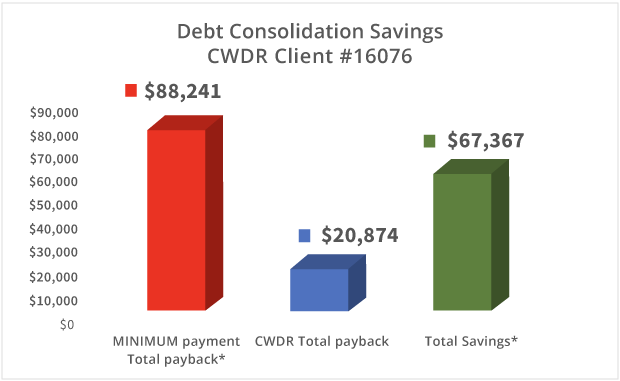

Case Study #16076 – Client saved $67,367 By Enrolling in CountryWide’s Debt Relief Program

THE PROBLEM:

Due to unexpected expenses and a sudden increase in his cost of living, Client # 16076 found himself continuing to borrow money to cover the costs. He was on a fixed income and consistently struggled to make ends meet, only diving deeper and deeper into debt. He quickly realized that making only minimum payments on his various debts was not helping, and his damaging cycle continued.

Finally, he decided it was time for help. He called the team at CountryWide to explore his options and to work through one of our plans.

THE SOLUTION:

Had Client #16076 continued to struggle, he would have found his financial situation worsening: If he had made minimum payments throughout the life of his loans, he would have paid a total of $88,241.

By turning to CountryWide, he was able to save money and become debt-free faster: Our team helped him consolidate his loans, score a lower interest rate, and create a plan to chip away at his debt. Within 41 months, he had paid off $34,140 in debt and was able to start fresh.

In total, he saved $67,367 in finance charges – and years of his life – by hiring CountryWide as his trusted debt relief partner.

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.

See What Our Customers Say

“I would like to take this time out to thank you for all your help… your debt relief program was the best thing I ever did … I have already recommended you guys to a few people who I know are trying to get out of debt. Words cannot describe how grateful I am for everyone’s help. I didn’t think I would ever find a solution to my problem. Thanks so! so! much. I wish I could hug everyone there. I really appreciate so much what you have done and what you are still doing.”

Barbara L.

Azusa, CA

Frequently Asked Questions

What debt consolidation options we offer?

We can help you negotiate your debts through our debt resolution program. We also have access to a network of Debt Consolidation lenders that we can refer you should you meet the criteria for a loan.

How long does it take to get out of debt?

We can offer payment plans ranging from 12-60 months. Your financial situation along with the creditors you are trying to consolidate will determine the amount of time it will take to get out of debt.

How much does it cost?

The cost for our program ranges anywhere from 15% to 30%. It is important to note that we only charge you a fee if we resolve and pay a debt for you and the fees will be included in the program payments you make and not an additional cost. Should you qualify and consider a consolidation loan from our lending partners, their APR range is 5.99% to 34.99%.

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (800)-594-3362