Generally, retirement means living on a fixed income. In preparing for retirement, money is saved to cover future living expenses, healthcare costs, and other regular expenses to allow older Americans to maintain their standard of living without relying on employment income. While it is ideal to enter retirement debt-free, for many Americans credit card debt carries with them into retirement. Often having high interest rates, credit card debt can be a source of stress in a period of life that should be enjoyable, relaxing, and stress-free. When burdened by the extra expense of credit card payments, a retiree’s plans for their retirement could be impeded.

So, what can you do to tackle your credit card debt if you were unable to pay it off before retirement? Here are a few tips to help you manage your debt quickly and efficiently so that you can make the most of your retirement years without the stress of debt.

Be strategic in making payments.

While some debt, like a low-interest car loan or the mortgage that allows you to deduct interest on your tax return, is not bad to have during retirement, credit card debt usually comes with high-interest rates and the required minimum payments can take away from money you need to enjoy your retirement. Therefore, it is important to prioritize your debt payments in a way that makes sense for your finances and is more beneficial to your financial health.

Repaying the debt you rightfully owe is important, but you should have something to show for that money. The interest that accrues on that debt is an avoidable expense and a waste of your money. Preserve your retirement funds by prioritizing the repayment of high interest balances first. Paying off these balances quickly allows you to limit the amount of money paid overtime to these debts. This strategy is known as the avalanche method. Once you have successfully paid off the credit card with the highest interest rate, you can prioritize payments on the next card that bears the highest interest rate.

Another strategy for paying off credit card debt is the snowball method, where you focus on paying off the card with the smallest balance first. This is an effective approach as it typically yields a quick result and allows you to see more progress as balances are paid off. However, because the credit card with the highest interest rate may be one of the cards with the highest balances, you could waste a lot of money in interest through this approach especially if you have several low-balance cards you focus on first.

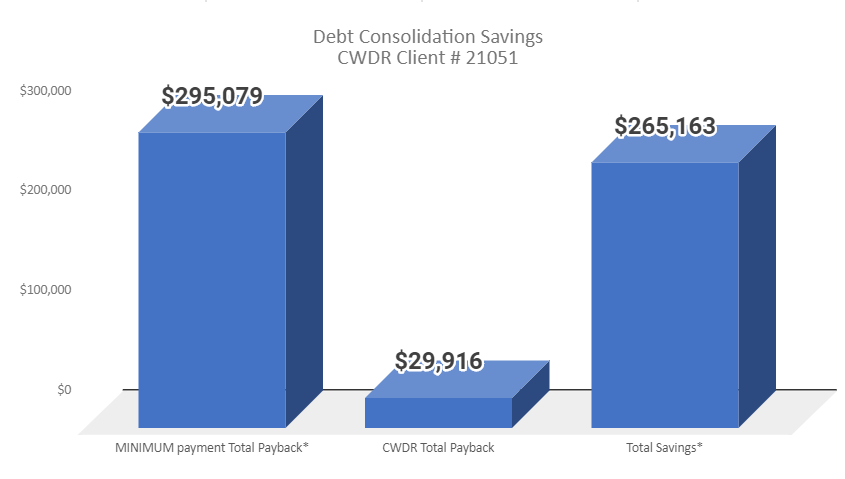

If you owe a significant amount of credit card debt over multiple accounts, debt consolidation may be a wise option. Debt consolidation can help with managing your payments and may lower your interest. Another way to help with payments and lower interest is to transfer your credit card balance(s) to a zero-percent interest account. However, opening a new credit card, while helpful for a low-interest balance transfer option, can be a risky move for your overall financial health and credit score. For assistance in determining which strategy is best for your financial situation, consult a financial advisor.

1. Choose your money source for credit card repayment wisely.

For most retirees, it is best to use cash from personal accounts, as opposed to retirement funds from investment accounts and other sources to make credit card payments. While you can quickly eliminate credit card debt through a lump sum courtesy of your retirement account, social security income, or pension proceeds, be mindful of the consequences of tapping these sources for extra money. The more money you take out of your retirement funds per year, the higher the income you must declare at tax time – which means what you may save in interest payments could be more than made up for through income tax dues.

Before relying on extra withdrawals from your retirement accounts to pay off outstanding debt, consult an experienced financial advisor or your tax professional to evaluate whether the tax consequences of these actions are worth the interest savings from paying off your credit card debt quickly instead of overtime.

2. Look for additional income sources.

Just because you are retired does not mean you cannot find something enjoyable to spend a few hours each week making some extra money. Sure, retirement is generally synonymous with the idea of a permanent vacation, but picking up a part-time job, flexible side hustle, or consulting gig with a former employer can bring in some extra cash to help you eliminate outstanding debt quicker without carrying the burden, stress, or time commitment of a traditional eight-to-five job. In avoiding traditional work, you can maintain the flexibility you desire to get the most out of your retirement while still supplementing your income.

If the idea of working during retirement is not appealing, there are plenty of other ways to come up with some extra cash to help pay off that credit card debt. Spend some time decluttering your home, and turn a profit on the clothing, furniture, or other items you do not need by having a garage sale or selling the items online. If you are not traveling as much, you could even downsize your vehicles to save more money.

Whatever you can do to free up more money to pay toward your credit cards now, will allow you to enjoy your retirement debt-free quicker. So, even if that means temporarily working a few hours each week, the benefit of that time will be long worth the sacrifice of working during retirement.