Debt Settlement

What is Debt Settlement?

Sometimes called “debt resolution” or “debt negotiation,” debt settlement is a way to reduce your debt in exchange for a lump-sum payment to your creditors.

How Do Debt Settlement Programs Work?

Most debt settlement programs follow a few steps:

STEP 1: Stop making payments on your unsecured loans.

STEP 2: Your debt settlement company will set up an account in your name. You will deposit money into the account as a lump-sum.

STEP 3: The debt settlement company will negotiate with your creditors for a reduced payment.

STEP 4: You pay your creditors the sum and they close your account.

What types of Debt are Eligible for Debt Settlement?

Generally, only unsecured debts are eligible for debt settlement programs. Some of these may include:

- Credit cards

- Medical bills

- Some private student loans

- Some types of business debts

- Personal loans

Is Debt Settlement a Good Idea?

Debt settlement isn’t the best option for everyone. It can hurt your credit score, and it may result in increased tax liability, as the amount of debt your creditors forgive is deemed taxable income.

Nonetheless, if you’re overwhelmed by your debt, trapped in a cycle of making minimum payments, or facing a serious financial hardship, this option offers several benefits:

- It lowers your principal balances, allowing you to take out a debt settlement loan to knock out your high-interest debts quickly.

- It streamlines your debt into a single amount owed.

- It is affordable.

- It has better repayment terms than a bankruptcy proceeding.

- It preserves a relationship of good faith with your creditors.

What’s The Best way to Settle My Debt?

Common options include the following:

A Debt Consolidation Program

This option helps consumers combine multiple debts with the goal of negotiating reduced payoffs with creditors. Consumers deposit funds in an escrow savings account for the purpose of paying off their debts. The debt consolidation company then uses the funds to negotiate a reduced payoff with creditors. LEARN MORE about Debt Consolidation Programs.

A Debt Management Program

Sometimes referred to as “credit counselling,” debt management programs involve working with a credit counsellor who will help you manage your debts by reducing your interest rates and/or extending your payback period. Your plan will typically require a monthly payment to your creditors, minus a monthly service fee charged by your debt management company.

Filing for Bankruptcy

Bankruptcy is generally a last resort option, as it can seriously impact your credit profile. Since bankruptcy involves resorting to the legal process, you will need to hire an attorney to help you navigate the proceedings. A judge will ultimately determine how your creditors should be paid.

Why Consider CountryWide Debt Relief?

With 30+ years of combined experience in helping people find a solution to getting out of debt, CountryWide Debt Relief can help you find the Best Debt Consolidation Option. Here are a few reasons why you should consider CountryWide Debt Relief:

See What Our Customers Say

“… Prior to working with Countrywide, our debt situation was completely out of control. The pressure exerted by creditors on our family and the associated financial and emotional stress created a really difficult situation…It is difficult in writing how the professionalism and outstanding services at Countrywide has enabled us to reduce stress, regain financial security while achieving a debt free life…I wanted to take this opportunity to sincerely thank you and your team for the work that you do to help families such as ours become debt free and live happier and more fulfilling lives.”

Barry G.

Worcester, MA

Proven Results

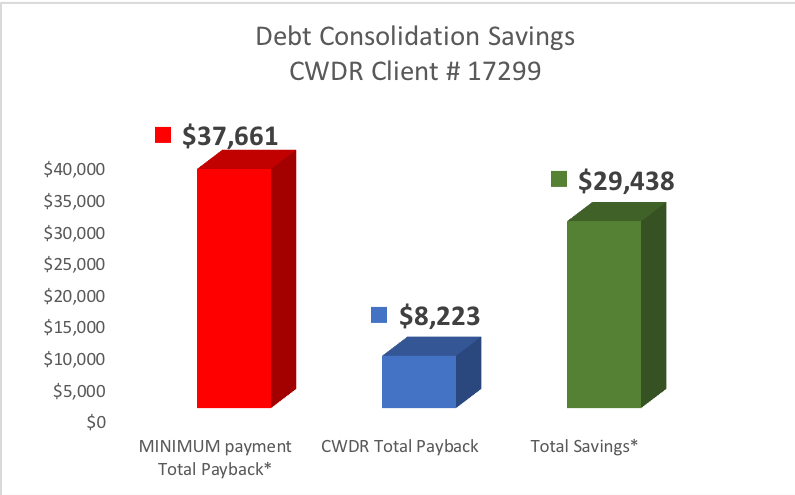

Case Study: Client #17299 from Worcester, MA Saved $29,438 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #17299 hired CWDR after going thru a Divorce. Client got into debt while adjusting to the new life and expenses after the Divorce. Client relied on Credit Cards to get back on their feet but then got stuck in the minimum payment trap. Living paycheck to paycheck and making just the minimum payments on the debts made the client realize that paying the debts off would be impossible.

THE SOLUTION:

CWDR was able to help Client #17299 thru our Debt Relief Program. Client had $11,596 in debt. Thru the Debt Relief program, CWDR was able to get the client out of debt in 40 months. Total paid back by the client was $8,223. If the client were to continue with just making the minimum payments on their debts, the client would have paid back $37,661. The client saved $29,438 by hiring CWDR.

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.

Frequently Asked Questions

How does debt settlement impact my credit?

Debt settlement could have a positive or negative impact on your credit. For instance, if you are delinquent on paying your creditors and you settle and pay the debt, you may see a positive impact on your credit. However, if you are not delinquent on your debts but you choose to settle, you may see a negative short-term impact. No matter your circumstances, it is generally more important to pay off your debts than to worry about the impact on your credit, because ultimately, achieving financial freedom is more important than maintaining a good credit score.

What is better, bankruptcy or debt settlement?

If you can afford to do so, settling your debts is usually better than filing for bankruptcy. However, if you cannot find a way to pay your creditors, consider consulting an attorney to see if a bankruptcy filing can provide the debt relief you need.

Should I hire a lawyer for debt settlement?

Debt settlement can be handled through a debt relief company or by a lawyer. When hiring professional help, weigh important factors like the reputation of the person or company you hire along with the cost associated with it.

How long does debt settlement take?

It depends on how much you owe and how much you can afford. However, in most cases, finding an affordable solution to paying off your debts matters more than the timeline associated with it.

Can you settle your debts on your own?

It depends on the severity of your debt situation. If you have a robust emergency fund and less than $7,500 in debt, you might be able to settle the debt on your own. Conversely, if you owe more and lack sufficient savings, then hiring professional help to settle your debts while keeping your financial stress low might make more sense.

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (800)-594-3362