Debt Consolidation

How Does Our Debt Consolidation Program Work?

Debt consolidation is a debt relief option that can help you become debt-free faster. It serves two purposes:

It helps You Manage Your Payments

Juggling multiple payment due dates and creditors can be overwhelming and frustrating. Not to mention, it makes it easy to accidentally skip a payment. By consolidating your debt, you can roll your various obligations into a single amount owed so that you only make one payment – with a single interest rate – each month. This makes it easier to focus on paying down debt while allowing you to see where your payments are going. It can also help you more easily track your progress in chipping away at your balance.

It can Reduce The Total Amount You Pay Back

Making minimum monthly payments to multiple creditors with varying interest rates can make it difficult to understand just how much you are paying throughout the life of your loans. By consolidating your debt, you can reduce the total payback amount and the time it takes you to pay off your debts.

Through our reputable debt consolidation program, you will work with our financial experts to select a debt relief plan that works for your financial situation. We will help you consolidate your debts and negotiate the most favorable interest rate possible given your total obligation and your credit score.

Is Consolidating Debt a Good Idea?

Consolidating your debt can be a good option for you if you are hoping to become debt-free faster and to avoid paying more than you should in interest. You may consider debt consolidation if:

Minimum payment trap

You are stuck making minimum payments while watching your total balance stagnate or increase.

Debt Reduction

You are struggling to come up with a plan to get out of debt and need the help of a professional.

Debt Legal action

You are being sued for not paying your debts

Affordability issues

You cannot afford to make your required monthly payments.

Who can qualify for Debt Consolidation?

There are different qualifications for a Debt Consolidation Loan VS Debt Consolidation program. Below is a summary of requirements to qualify:

| QUALIFICATIONS | Debt Consolidation Loan | Debt Consolidation Program |

|---|---|---|

| GOOD CREDIT | YES – Must have good credit | NO – Can qualify with good or bad credit |

| FINANCIAL STABILITY | YES – Must be able to prove that you can service your debts | NO – Can qualify even if your debts are greater than your assets |

| GOOD DEBT/INCOME RATIO | YES – Must be able to prove that you can afford payments | NO – Can qualify even if you can’t afford payments or have been delinquent on making your payments |

How Do I Consolidate My Debt?

There are two primary options for consolidating your debt: Applying for a debt consolidation loan and engaging in a debt consolidation program.

Debt Consolidation Loan

A debt consolidation loan involves applying for a loan to pay off your various debts. You will then pay that loan back in a series of monthly payments with a negotiated interest rate and payback schedule.

A debt consolidation loan makes it easy to manage your monthly payments and can also reduce the amount of interest you pay over time. However, in order to qualify for a debt consolidation loan, you need to have good credit and prove that your income is sufficient to pay it back.

Debt Consolidation Program

The goal of a debt consolidation program is to consolidate your debts so that only one monthly payment is required. This involves working with a debt relief professional who negotiates with your creditors to reduce your interest rates and your total debt obligation.

Debt consolidation programs can be done without seeking an additional loan and can reduce the total amount you need to pay your creditors. This is a good option for those with bad credit.

Debt Consolidation Programs for Bad Credit

If your credit score is poor, you can enroll in a debt consolidation program to help you become debt-free. Reach out to us for more information.

Do I Qualify for Debt Consolidation?

The requirements for debt relief and debt consolidation are different.

For instance, in order to apply for a debt consolidation loan, you need to have good credit and prove that you can cover your payments. For a debt consolidation program, however, you can have bad credit and may qualify even if your debts exceed your net worth.

Contact us if you have questions about whether you qualify for a loan or if we can help you consolidate your debts through our reputable debt consolidation program.

Why Consider CountryWide Debt Relief?

With 30+ years of combined experience in helping people find a solution to getting out of debt, CountryWide Debt Relief can help you find the Best Debt Consolidation Option. Here are a few reasons why you should consider CountryWide Debt Relief:

See What Our Customers Say

“… I was drowning in debt…My creditors were driving me crazy with the phone calls threatening to take a legal action against me if I didn’t pay my credit card balances in full, hell I couldn’t even pay the minimum payment… Countrywide debt Relief has done exactly what they said they would. Because of their negotiating skills my debt was reduced by 40-60% and I’m on my way to being debt free.”

Larry S.

Lanesville, IN

Proven Results

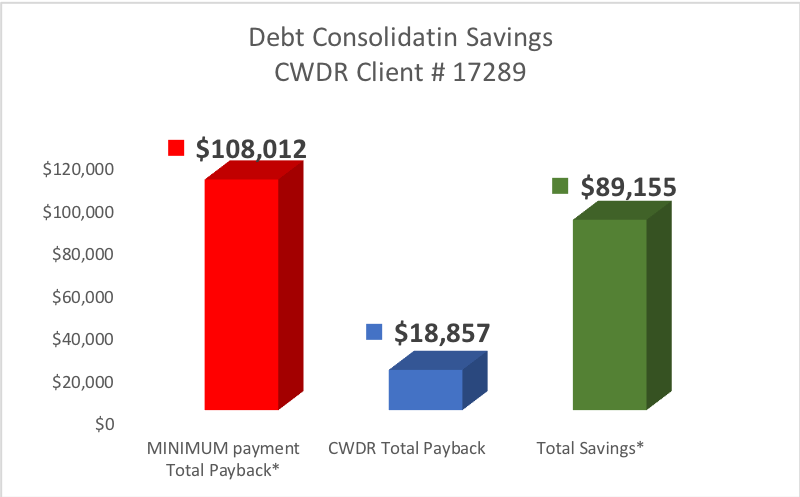

Case Study #17289 – Client from Lanesville, Indiana saved $89,155 by enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

Client #17289 hired CWDR when a significant other in the household was injured in a boating accident resulting in loss of job and income. Due to the reduction in income the client could no longer pay the required monthly payments to creditor and needed to find a way to reduce the monthly payments.

THE SOLUTION:

CWDR was able to help client #17289 thru our Debt Consolidation Program. Client had $32,115 in debt. Thru the Debt Consolidation Program, we were able to help the client get out of debt in 45 months. Client paid back a total of $18,857 to get out of debt. If the client were to make just the minimum payments to their debts, the client would have paid back estimated $108,012. Client saved $89,155 by enrolling in CWDR Debt Consolidation Program.

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.

Frequently Asked Questions

Can I get out of debt faster by consolidating my payments?

Yes. You can reduce the amount of finance charges you pay by consolidating your debt into a single amount owed. You can also reduce the amount of principal you pay back over time.

Can I get a debt consolidation loan with a poor credit score?

As noted above, our debt consolidation program works for those with poor credit. However, the interest rates for those with poor credit scores are generally higher than the debt that is being consolidated. When deciding which path to take to pay down debt, it’s best to examine all your options rather than just applying for a consolidation loan.

Will debt consolidation affect my credit score?

Generally, yes, but the effect depends on the consolidation option for which you qualify. Your ultimate goal should be to get out of debt because being financially stable is the key to building a good credit score.

How much will it cost to consolidate my debt?

The cost depends on the amount of debt you owe and the consolidation options for which you qualify. However, it is important to remember that ignoring your debt and letting your principal amount continually increase is the costliest option.

Does debt consolidation work on a limited income?

Yes. If your income is limited or variable, you can benefit from consolidating your debts.

Are debt consolidation loans taxable?

No: However, if you settle portions of your debt, the amount forgiven may be deemed taxable income.

How can I get a debt consolidation loan?

Seeking a debt consolidation loan requires engaging a lender to review your credit as well as your debt-to-income ratio. Keep in mind that debt consolidation loans are not always the best or cheapest option. Before deciding on a path to financial freedom, take time to compare all debt consolidation options and choose the one that is best for your situation.

How can I get approved for a debt consolidation loan with bad credit?

If you are worried about your bad credit, consider applying to multiple providers to see who offers the most favourable rates for those with poor credit scores.

What happens when you use a debt consolidation company?

When consumers engage a debt consolidation company to help them pay down their debts, they generally have one goal: financial freedom. By working with a debt consolidation company, you gain the benefit of a financial expert who can help you craft the best financial plan, tailored to your specific needs, and will help you navigate the process of becoming debt-free.

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (800)-594-3362