Tim Saighani

-

How Credit Card Minimum Payments can Trap You

By

on

Topics: Credit CardYou might be tempted to use your credit cards, increase your balance, and then the minimum payment at the end of the month. However, taking this approach can trap you into a vicious cycle of debt that’s hard to escape.

-

Are You Saving Enough for Retirement? Here’s How to Find Out

By

on

Topics: Money SavingIt’s hard to know how much we should be saving for retirement. Various rules of thumb circulate, but deciding how much to save is a personal decision that hinges on personal factors – from lifestyle preferences to current and future income levels.

-

Debt Settlement Dos and Don’ts

By

on

Topics: Debt SettlementFor many consumers, debt settlement offers a chance to get out of debt more quickly. Here are a few key dos and don’ts to help you navigate the process if you’re embarking on your own debt settlement journey.

-

Five Money Management Skills to Improve Your Finances

By

on

Unless you were lucky enough to grow up in a household that taught basic money management skills, you might find yourself a bit lost. Read on for five money management skills that will help you improve your finances.

-

Six Ways to Tackle Your Maxed-Out Credit Cards

By

on

Topics: Credit CardIf you’ve overused your credit cards and maxed out one (or more), it’s time to get back on track. Here are six ways to deal with those maxed out cards and to get yourself back on track.

-

How Americans are Spending Their Excess Cash

By

on

Topics: Personal FinanceYou don’t have to become a miserly penny pincher to develop responsible financial habits – but it is important to understand why Americans get into so much trouble with overspending and debt.

-

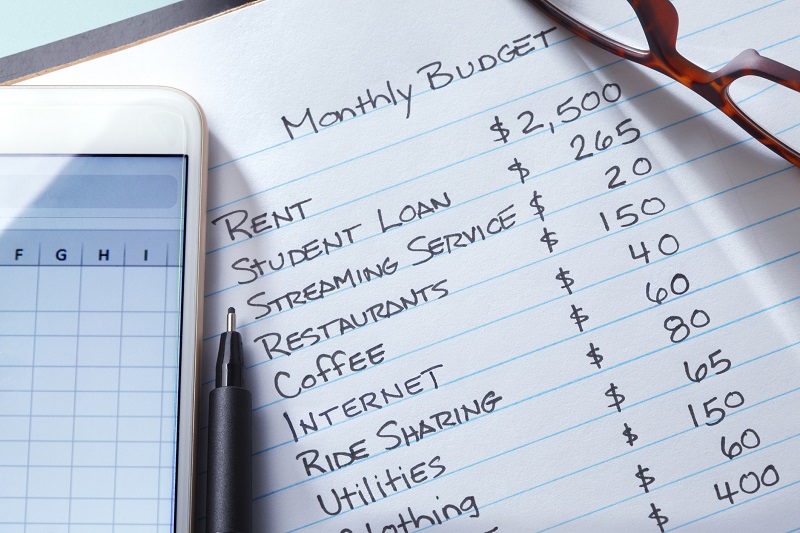

Budgeting Tips to Keep You out of Debt

By

on

Topics: Money SavingWise saving and budgeting happens over time, not overnight. Here are twenty money-saving tips to help you build wealth and stay out of debt.

-

Best Debt Settlement Options

By

on

Topics: Debt SettlementKnowing your debt relief options, whether it is with the help of a debt settlement company or negotiations on your own, will help you to choose the right strategy to resolve your debt.

-

How Do Debt Consolidation Programs Work?

By

on

Topics: Debt ConsolidationDebt consolidation has helped thousands of consumers pay down their high-interest debts and become debt free. But before you take this path, make sure you understand how debt consolidation works and whether it would be the best option for you.

-

The Difference Between a Credit Score and a Credit Report

By

on

If you’ve decided to take control of your debt, you probably know that your credit is one of the key pillars of personal finance. Here, we break down the differences between your credit score and your credit report.

Get Out of Debt

Easy Process, Fast Approvals

Bad Credit OK

1 Low Monthly Payment

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (877) 784-1104