Proven Results

A company is only as good as the results it delivers. We take pride in putting our customers first.

Here are some examples of how we’ve helped customers worldwide.

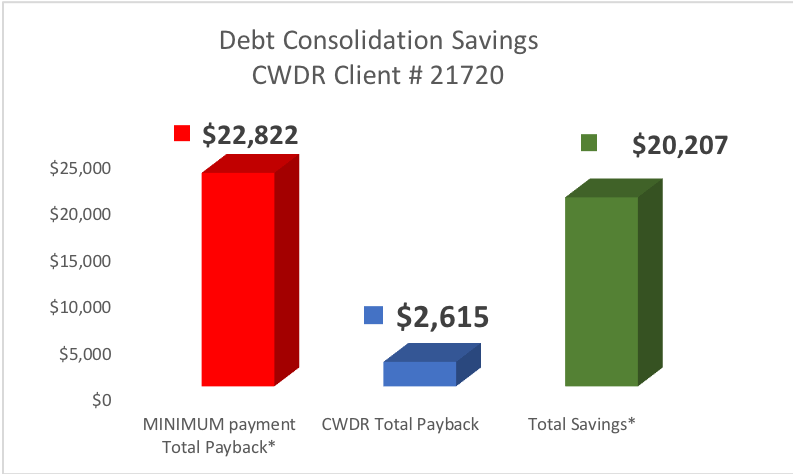

Case Study #21720 – Client from Phoenix, Arizona, saved $20,207 by Enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

Client #21720 fell behind on his payments. When his work hours decreased, he lost the income he needed to support his family. He had nothing left over to pay his creditors.

He turned to CountryWide for help.

THE SOLUTION:

By setting up an affordable monthly payment schedule, CountryWide’s financial experts helped him find relief. The client was able to save funds on a monthly basis. Within ten months, he was debt-free.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

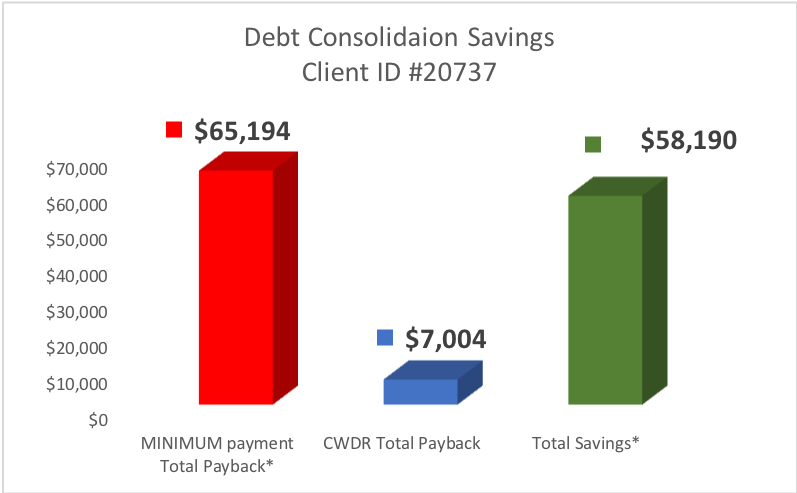

Case Study #20737 – Client from Azusa, California, saved $58,190 by Enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

Client #20737’s mortgage payments increased. Because of this, he struggled to cover his other bills, including his son’s private school tuition. He made small payments on his credit cards but failed to make even the minimum payments. He turned to CountryWide.

THE SOLUTION:

CWDR helped the client pay down $19,627 in 21 months. As a result, he saved $58,190 in interest payments by hiring CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

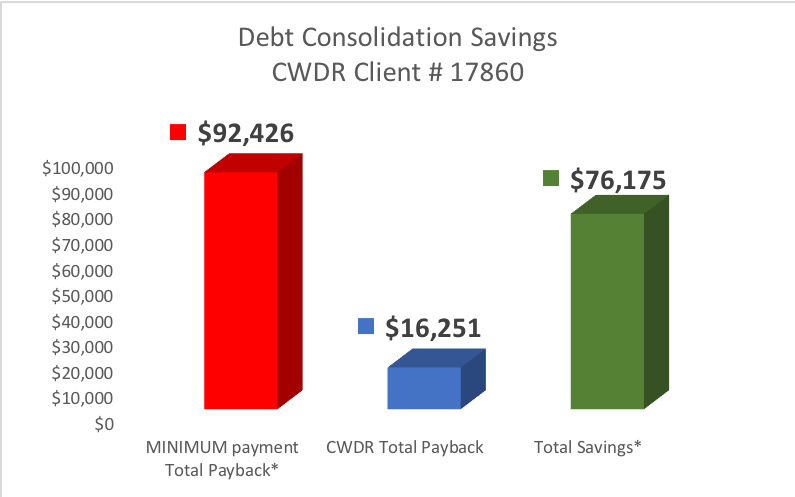

Case Study #17860 – Client from Tampa, Florida, saved $76,175 by Enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

When Client #17860 got divorced, he struggled to manage his bills. He turned to CountryWide to learn about his debt settlement options.

THE SOLUTION:

By setting up a debt settlement plan, CWDR helped the client pay off $27,569 in debt in 32 months. He saved $76,175 in interest payments by hiring CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

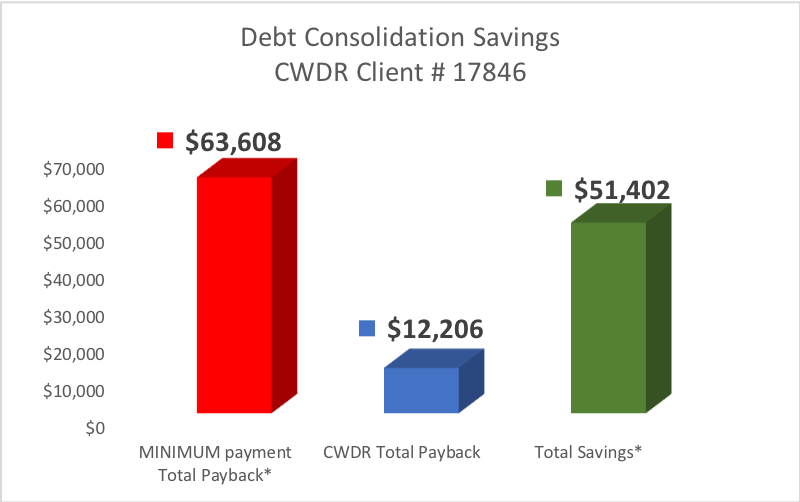

Case Study #17846 – Client from Pensacola, Florida, saved $51,402 by Enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

Client # 17846 was on a fixed income. As his cost of living increased, he relied on credit cards to cover his expenses. He reached out to CountryWide for help consolidating his debts.

THE SOLUTION:

CWDR helped the client consolidate his credit card debts. As a result, he paid off $19,164 in debt in 53 months and saved $51,402 in interest payments.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

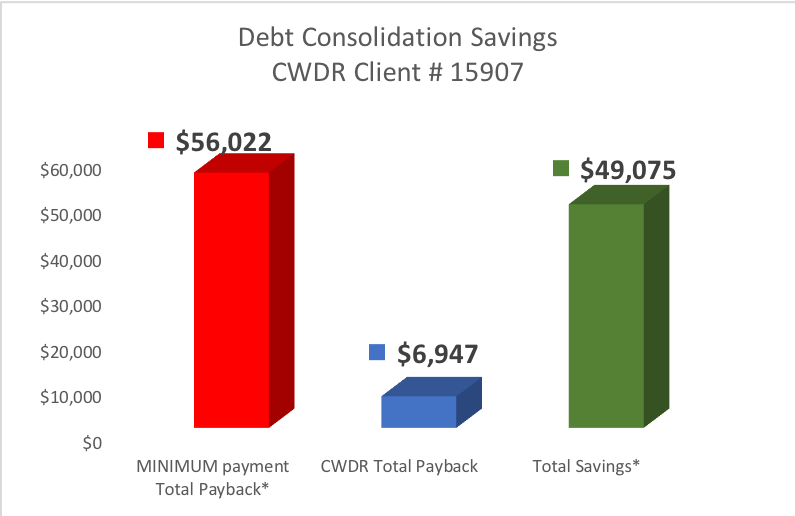

Case Study #15907 – Client from Kroll, Florida, saved $49,075 by Enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

When Client #15907 retired, he turned to CountryWide for help settling his debts.

THE SOLUTION:

CWDR helped the client payoff $16,951 in debt in 28 months. The Client saved $49,075 in interest payments by hiring CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

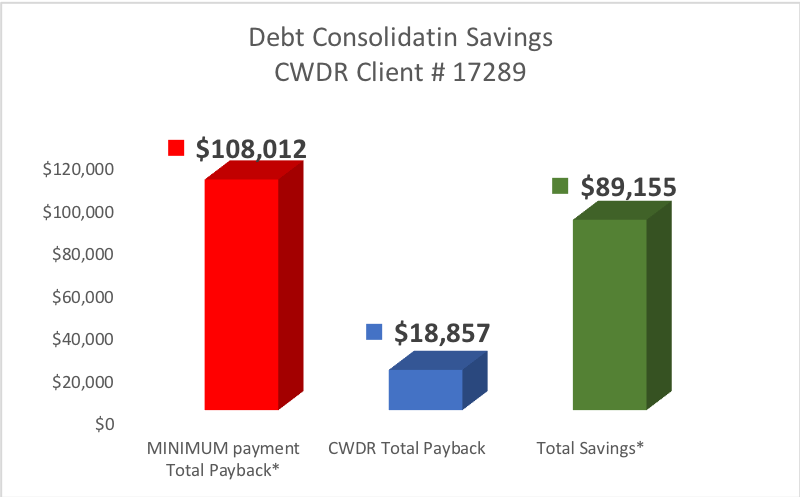

Case Study #17289 – Client from Lanesville, Illinois, saved $89,155 by enrolling in CountryWide’s Debt Consolidation Program.

THE PROBLEM:

Client #17289 hired CWDR when her significant other lost his job after a serious boating accident. With the reduction in their household income, the client and her partner struggled to make their required monthly debt payments. In total, the client faced $32,115 in debt.

THE SOLUTION:

By enrolling in our debt consolidation program, we helped the client pay down her debt in 45 months. She paid back a total of $18,857 to get out of debt. If she had continued making minimum payments, she would have paid approximately $108,012. She saved $89,155 by turning to CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

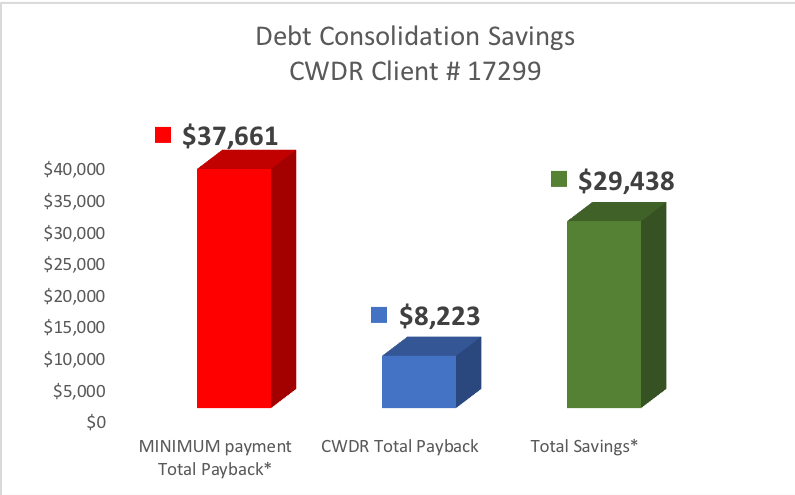

Case Study #17299 – Client from Worcester, Massachusetts, saved $29,438 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #17299 hired CWDR after a divorce. She had relied on credit cards to get back on her feet financially, but got trapped in a cycle of making minimum payments. She was tired of living paycheck to paycheck and quickly realized that continuing to make the minimum payments on her debts would only worsen her situation.

She turned to CountryWide for help.

THE SOLUTION:

By enrolling in CountryWide’s debt relief program, the client resolved a debt load of $11,596 by paying back $8,223 in 40 months. If the client were to continue making the minimum payments, she would have paid $37,661. The client saved $29,438 by hiring CWDR.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

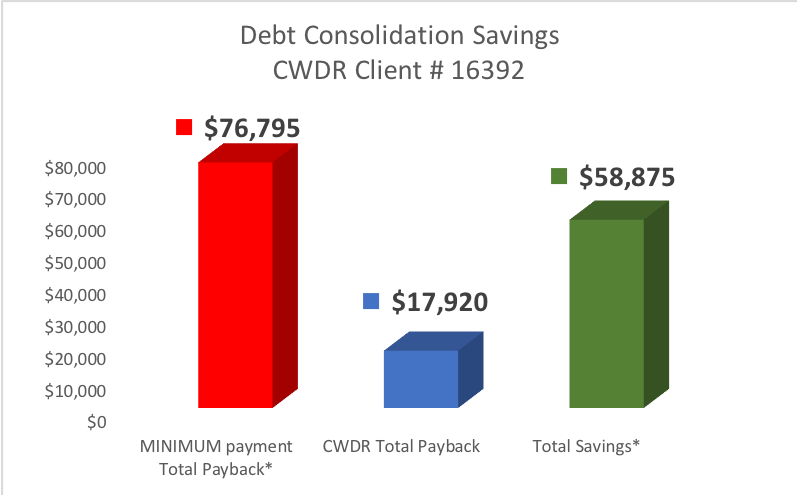

Case Study #16392 – Client from Philadelphia, Pennsylvania, saved $58,875 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #16392 hired CWDR for debt consolidation help after losing a large portion of her income. With her balances and interest increasing, she turned to CountryWide for help.

THE SOLUTION:

CWDR helped the client pay off $23,010 in debt in 49 months through a tailored debt consolidation plan. The client saved $58,875 in interest payments by hiring CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

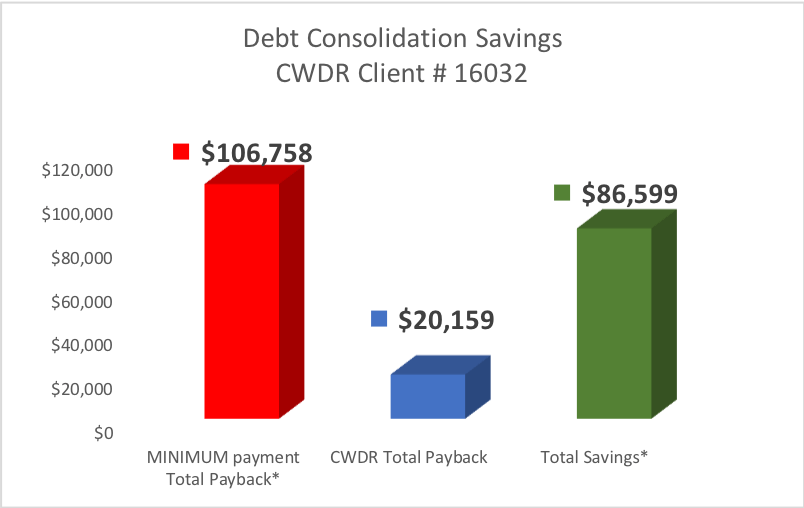

Case Study #16032 – Client from White Haven, Pennsylvania, saved $86,599 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #16032 and her husband were disabled and struggled to find steady employment. Coupled with their steep medical bills, their financial situation led them deeper and deeper into debt.

THE SOLUTION:

CWDR helped the client and her spouse create a debt consolidation plan. Within 46 months, they paid off $31,749 in debt and saved $86,599 in interest.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

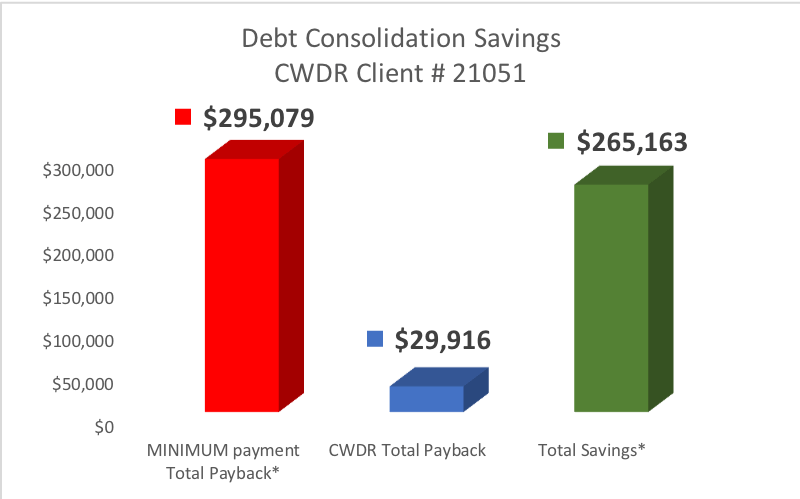

Case Study #21051 – Client from West Hills, California, saved $265,163 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #21051 made a bad investment decision that resulted in a substantial loss of income – and his home. He turned to CountryWide for help settling his debts.

THE SOLUTION:

CWDR helped the client pay off $86,677 in debt in 25 months. He saved $265,163 in interest by hiring CountryWide Debt Relief.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

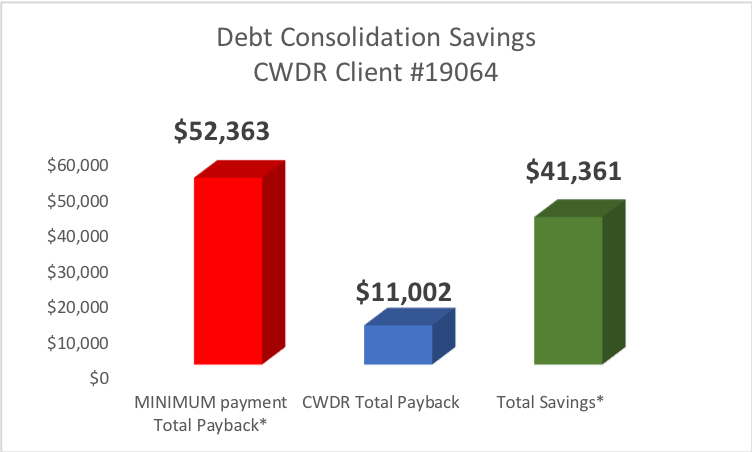

Case Study #19064 – Client from Oceanside, California, saved $41,361 by enrolling in CountryWide’s Debt Relief Program.

THE PROBLEM:

Client #19064 hired CWDR for help navigating debt and escaping a minimum payment trap after losing the assistance of a financial provider.

THE SOLUTION:

CWDR helped the client consolidate her credit card debt, saving her $41,361*. With $15,844 in debt, the client would have taken 523 months to pay off her debt if she’d continued making only minimum payments. CountryWide helped her get out of debt in 39 months.

*Doing nothing assumes making only the minimum payments on the debts each month with an APR of 17% and a minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Illustration shows the difference between the total payments to CWDR and total payments if just the MINIMUM monthly payments were being paid on the debts.

Get Your Free Consultation Now!

Approval is GUARANTEED*. Process is FAST and EASY!

Call us now: (800)-594-3362