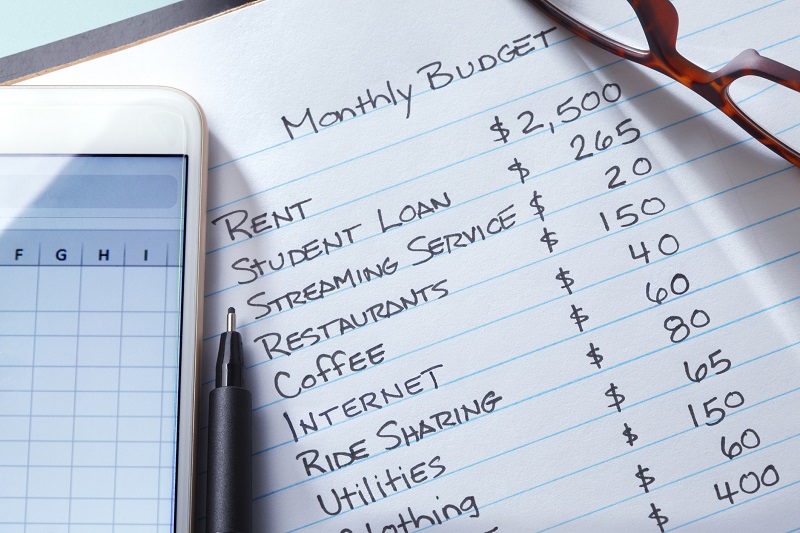

The best way to get out of debt is to avoid falling into it in the first place, and that starts with living a savvy, frugal lifestyle. Here, we share twenty tips to budget, scrimp, and save, so that living on credit becomes not only unnecessary but undesirable.

1. Plan your Meals

Taking time to plan out what you will eat for breakfast, lunch, and dinner in a given week is a surefire way to save up to hundreds of dollars a month in takeout, coffee orders, and lunch runs to the hot dog stand. When you plan your meals, write out a detailed grocery list including only the items you need to make those meals. To stave off the temptation to simply order a pizza, prepare as many meals as possible in advance so you have them on hand.

Taking time to plan out what you will eat for breakfast, lunch, and dinner in a given week is a surefire way to save up to hundreds of dollars a month in takeout, coffee orders, and lunch runs to the hot dog stand. When you plan your meals, write out a detailed grocery list including only the items you need to make those meals. To stave off the temptation to simply order a pizza, prepare as many meals as possible in advance so you have them on hand.

2. Never Grocery Shop while Hungry

You will spend substantially more if you hit the store on an empty stomach, as those unhealthy (and pricier) items in the middle aisles will look particularly good. Stick to the outermost aisles in the store, which are generally filled with unprocessed, and thus healthier and cheaper, foods.

3. Turn Down your Hot Water Heater

Turn your dial down from the recommended 140 degrees to 120 degrees. Depending on the size of your home and your water usage, this can potentially save you hundreds of dollars a month.

4. Raise your AC and Lower your heat

We all like to be comfortable, but don’t be so quick to crank your AC down in the summer (or to blast your house with heat during the winter). By choosing to position a fan by an open window in the summer and layering up with down blankets and wool sweaters in the winter, you can see substantial savings in your energy bills.

5. Buy Organic Produce only Selectively

Organic isn’t always advantageous. While non-organic berries and certain vegetables with permeable skin tend to carry more toxins, items with a waxy cover or peel – like bananas or squash – are shielded from the harmful chemicals infused through pesticide treatments. Before you simply commit to buying all organic, consider whether it is necessary.

6. Buy in Bulk – but only when it makes Sense

Shopping at wholesale warehouses like Costco can save you money, but only when you purchase selectively. For instance, stocking up on fresh produce in bulk will only prove wasteful when it spoils before you’re able to eat it all. When bulk shopping, always be sure to compare unit prices to those at a traditional grocery store to ensure that you are actually saving money.

7. Embrace your Old Cars

Avoid the temptation to “level up” your vehicle when yours starts to age and look increasingly less attractive or flashy. Car payments land hundreds of families in debt. Not to mention, cars depreciate steadily and as such, as not investments. Drive your old, paid-off vehicle for as long as you can.

8. Recycle Rainwater

Install a rain barrel in your yard to catch runoff from your gutters. Use this water on your plants and grass to cut back on your summer water bill.

9. Buy Generic

Yes, this applies to many over-the-counter medications as well as food! Compare labels to confirm that the generic and brand name products contain the same components and if so, opt for the less expensive option.

10. Pass on the Wine Menu

Choosing to imbibe while out to eat can double or triple your bill. If you are a wine lover, stock up at home instead of purchasing a marked-up glass at a restaurant.

11. Have an “Eat What you Have” Week

Periodically, choose a week to skip the grocery store and create meals using only what you have in your pantry, refrigerator, and freezer. This is a great opportunity to use the bags of canned and dry goods you purchased but never opened, as well as using up aging (but still good) produce in your fruit basket rather than tossing it in favor of a newer and more attractive option.

12. Skip Starbucks

A small Starbucks latte costs about $5, so a daily habit will run you $20 a week, $100 a month, and $1200 a year. A bag of Starbucks whole beans from the grocery store, on the other hand, costs between ten and fifteen dollars, and a pound of beans can yield about 70 servings of coffee.

13. Mindlessly Save

Create a separate savings account and set it to auto-draft from your primary checking account. That way, you will build savings without having ever seen – or missed – the money.

14. Track your Savings Progress

Using an app like Mint.com or Everydollar.com, track your spending habits and keep tabs on how much money you are saving each month. Seeing your expenditures plainly will keep you honest, and challenging yourself to trim nonessentials as much as possible (and to watch your savings amounts, in turn, increase each month) is a fun and fulfilling way to save more.

15. Maintain Good Credit

Should you need to take out a loan, like a mortgage, a solid credit score will save you ample amounts on interest. To maintain good credit, pay your bills on time and keep your debt levels as low as possible.

16. Use Cash

As much as possible, make purchases with cash rather than putting them on credit. If you prefer to use a credit card, pay the balance immediately (preferably each month or even more) to avoid carrying a balance. When using a card, maintain the same rule of thumb you would use for cash: If you lack the funds for it, don’t buy it!

17. Unsubscribe from Vendor Emails

Those tempting sales that are hitting your inbox aren’t helping you save! If anything, they’re tempting you to spend money you hadn’t planned on spending. Unsubscribe to avoid the temptation.

18. Get a Side Gig

Having several revenue streams is an excellent way to build wealth. Use the extra money to build up your nest egg, save for retirement, pay down debt, or to enjoy “extras” that your primary income would not cover.

19. Sell your Stuff

If you take an honest inventory of your home, you likely have multiple items that you haven’t touched in years, but that others would enjoy. Collect items with which you can easily part and sell them on Craigslist, eBay, or at a garage sale.

20. If you Overspend, Simply get Back on Track

Don’t panic if you’ve run afoul of your budgeting goals. The key is to simply avoid making them habitual. If you overspend one month, rein in your budget the next month to make up for it. Wise saving and budgeting happens over time, not overnight, so give yourself some credit.