Credit Card Debt Lawsuits

BBB Accredited

30 Years of Combined Experience

Free Consultation

When you apply for a credit card, you enter into a cardholder agreement with the credit card issuer. A legal document outlining the terms under which the credit is offered is provided. Your agreement generally describes a detailed contract to borrow money, essentially a loan, that is paid back over time with accruing interest. Payments typically take the form of monthly installments.

Sometimes life’s hurdles can move you to fall delinquent on your monthly installments. This is considered a breach of your agreement with the credit card company. When this happens, the issuing creditor may pursue legal avenues to collect any unpaid balances along with any potential residual dues such as late or legal fees. Usually this is initiated with a legal document sent to you, the consumer. While it may be tempting to ignore or toss these notifications aside, failure to respond can bring serious consequences.

What Can Happen If You Do Nothing After A Creditor Initiates Legal Proceedings?

There are several different avenues you can employ to handle a credit card lawsuit. Although only an attorney can counsel you about your legal rights, an experienced debt relief professional may also be able to help you resolve your delinquency and put a halt to any legal proceedings initiated by your credit issuer. No matter which path you choose to help you, the very worst thing you can do is nothing.

Failure to respond to a lawsuit can result in the forfeiture of your rights to later defend yourself. This can result in the credit issuer seeking – and likely receiving – a default judgment against you. Once the creditor gets a legal judgement against you, there is potential to get an order to seize your assets.

Although the specific rules on what a creditor can seize vary by state, generally, you may face:

- Garnishment of funds from your bank account

- Garnishment of wages

- A lien recorded against your property

What To Do If You Get Sued For A Credit Card Debt

The appropriate measures to take will vary based on your individual circumstance. However, because such serious consequences can result from doing nothing, it’s advisable to explore all your options so that you don’t relinquish your right to defend yourself or potentially resolve your delinquency with the credit issuer.

Keep in mind that the lawsuit will not simply dissolve itself if you ignore it. It’s best to assume a direct approach and seek professional guidance.

What are some of the most common credit card companies that file lawsuits?

Capital One Bank

Discover Bank

American Express

Bank of America

Chase

Citibank

Credit One Bank

Synchrony Bank

Wells Fargo Bank

Barclays Bank

How it works

Creditor Files Suit

You get Served

You Hire Professional Help

Debt is Resolved

Why Consider CountryWide Debt Relief?

With 30+ years of combined experience in helping people find a solution to getting out of debt, CountryWide Debt Relief can help you find the Best Debt Consolidation Option. Here are a few reasons why you should consider CountryWide Debt Relief:

See What Our Customers Say

“I originally heard about Countrywide Debt Relief via the pink flyer that I received at my home earlier this year. I responded to the flyer and I am very glad that I did. Prior to working with Countrywide, our debt situation was completely out of control. The pressure exerted by creditors on our family and the associated financial and emotional stress created a really difficult situation. The kind and understanding people at Countrywide helped us come up with a payment plan that would be sustainable and ultimately enable us to cope with the debt while dealing in a fair and straightforward manner to those to whom we owed money. They have been dealing directly with our creditors relieving the stress and thereby enabling us to resume our lives, and livelihoods, creating a real path out of financial difficulties. It is difficult in writing how the professionalism and outstanding services at Countrywide has enabled us to reduce stress, regain financial security while achieving a debt free life. This has had broad and positive implications for the happiness and opportunity my family has now regained. I wanted to take this opportunity to sincerely thank you and your team for the work that you do to help families such as ours become debt free and live happier and more fulfilling lives.”

Barry G.

West Hills, CA

Proven Results

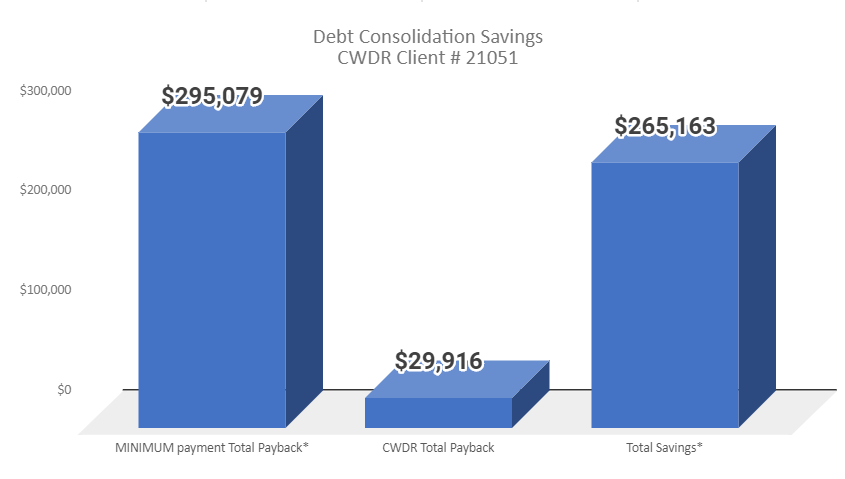

Case Study #21051 – Client from West Hills, CA saved $265,163 by enrolling in CountryWide’s Debt Consolidation Program

THE PROBLEM:

Client #21051 needed debt consolidation help because they were sued by a creditor after losing their business and falling behind on paying their bills. The client did not want to file for Bankruptcy to stop the lawsuit from the creditor, so they looked for other options.

THE SOLUTION:

Client # 21051 hired CountryWide Debt Relief to help settle and pay off their past due debts. They were able to pay off $86,677 in total debt including the creditors that filed a collection lawsuit. Making just minimum payments on this much debt, the client would have had to pay back an estimated $295,079 over 813 months of minimum payments. By utilizing the Debt Consolidation program from CWDR, they paid off their debts in 25 payments for a total of $29,916 saving $265,163.

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.