Debt Buyer Lawsuits

BBB Accredited

30 Years of Combined Experience

Free Consultation

If you stop paying your debts, your creditor may choose to sell your account to a debt buyer – a company that purchases debts from creditors for pennies on the dollar and then seeks to collect on the debt. When this happens, the debt buyer becomes the new entity that expects payment. If you continue to miss your payments, the debt buyer may eventually sue you to collect your unpaid account.

What could happen if you do nothing after a debt buyer sues you?

Failing to respond to a debt buyer lawsuit carries serious consequences. Most importantly, failure to respond can mean giving up your right to deny the allegations in the lawsuit. The debt buyer can then ask a judge to grant a default judgment against you, allowing it to come after your personal assets. In many states, this may allow a debt buyer to:

- Withdraw funds from your bank account

- Garnish your wages

- Put a lien on your home

The rules vary state by state as to what exactly a debt buyer can take and what types of property are protected. Nonetheless, it’s important to know that in almost every state you stand to lose something by failing to respond to a debt buyer’s lawsuit.

What to do if you get sued by a debt buyer

Sometimes, debt buyers don’t have sufficient documentation to support their claims. As such, if you are sued by a debt buyer, you may be able to raise certain defenses to reduce your liability. Consider engaging professional help to help you resolve your case. The options to resolving your case depend, in part, on what the debt buyer is alleging in their lawsuit against you. You can hire a debt relief company to settle the debt and an attorney to fight the allegations in the lawsuit.

No matter which specific route you take, it’s vital to act quickly so you don’t forfeit your right to defend yourself or to settle the lawsuit before it’s too late.

What are some of the common debt buyers that file lawsuits?

Midland Funding AKA Midland Credit

Portfolio Recovery Associates

LVNV Funding

CACH LLC

Mountain Lion Acquisitions

Persolve and Associates

JH Portfolio Debt Equities

Cavalry SPV / Calvarly Portfolio Services

GCFS

Absolute Resolutions Investments

How it works

Creditor Files Suit

You get Served

You Hire Professional Help

Debt is Resolved

Why Consider CountryWide Debt Relief?

With 30+ years of combined experience in helping people find a solution to getting out of debt, CountryWide Debt Relief can help you find the Best Debt Consolidation Option. Here are a few reasons why you should consider CountryWide Debt Relief:

See What Our Customers Say

“I originally heard about Countrywide Debt Relief via the pink flyer that I received at my home earlier this year. I responded to the flyer and I am very glad that I did. Prior to working with Countrywide, our debt situation was completely out of control. The pressure exerted by creditors on our family and the associated financial and emotional stress created a really difficult situation. The kind and understanding people at Countrywide helped us come up with a payment plan that would be sustainable and ultimately enable us to cope with the debt while dealing in a fair and straightforward manner to those to whom we owed money. They have been dealing directly with our creditors relieving the stress and thereby enabling us to resume our lives, and livelihoods, creating a real path out of financial difficulties. It is difficult in writing how the professionalism and outstanding services at Countrywide has enabled us to reduce stress, regain financial security while achieving a debt free life. This has had broad and positive implications for the happiness and opportunity my family has now regained. I wanted to take this opportunity to sincerely thank you and your team for the work that you do to help families such as ours become debt free and live happier and more fulfilling lives.”

Barry G.

West Hills, CA

Proven Results

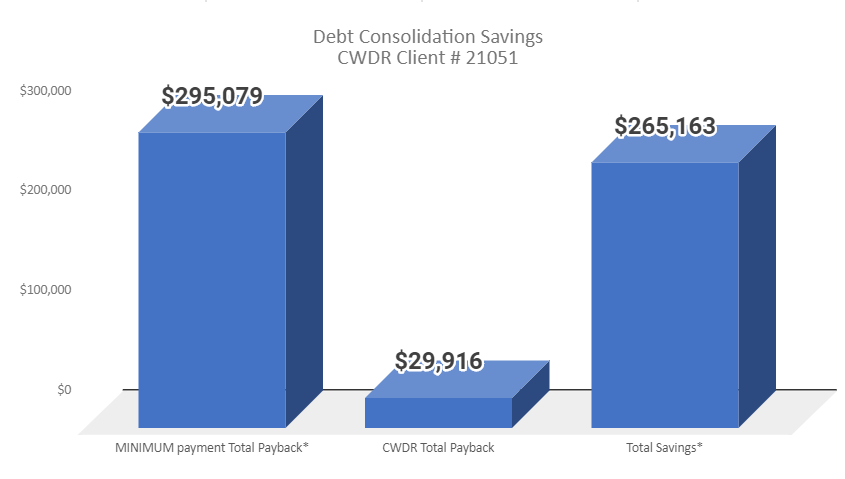

Case Study #21051 – Client from West Hills, CA saved $265,163 by enrolling in CountryWide’s Debt Consolidation Program

THE PROBLEM:

Client #21051 needed debt consolidation help because they were sued by a creditor after losing their business and falling behind on paying their bills. The client did not want to file for Bankruptcy to stop the lawsuit from the creditor, so they looked for other options.

THE SOLUTION:

Client # 21051 hired CountryWide Debt Relief to help settle and pay off their past due debts. They were able to pay off $86,677 in total debt including the creditors that filed a collection lawsuit. Making just minimum payments on this much debt, the client would have had to pay back an estimated $295,079 over 813 months of minimum payments. By utilizing the Debt Consolidation program from CWDR, they paid off their debts in 25 payments for a total of $29,916 saving $265,163.

*Do nothing option assumes making only the minimum payments on the debts each month with APR of 17% and minimum payment of 2% of the outstanding balance each month.

Source: creditcards.com/calculators/minimum-payment.php.

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.